D3 following better-than-expected Q2 delivery numbers

Market Context & Daily Chart

Indexes have been on a tear; two large green days on the Qs preceding today with intraday PA being very similar on all these days – brief p/b at the open followed by a slow grind higher for the rest of the session; today was going to be no exception with relentless strength and shallow dips being bought aggressively. Broader market overextended by almost all technical measures but no sign of capitulatory PA yet, still orderly.

- TSLA had been by far the weakest of the Mag 7 trading down 25% YTD when it broke above the DTL on 6/26 on the approval of Elon’s $56B pay package

- Break above 02/24 swing highs on HRV on 07/01

- The catalyst that ignited the parabolic move were better-than-expected Q2 delivery numbers in the PM on 07/02 (444k deliveries vs 437.8k(e))

- Sentiment was extremely poor and expectations low; 07/01 headlines:

- Tesla stares at another sales decline in Q2

- Tesla does not look like a Magnificent 7 stock anymore (WFC)

- Fund manager predicts 4% shortfall, Ross Gerber calls it a “low but special number”

– just a small snippet from IB’s news section showcasing sentiment and (thus likely) positioning. It wouldn’t take much to catch a large number of market participants off guard

- TSLA gapped up on that number and closed the days at highs

- 07/03 gap up continuation with another ~5.5% intraday gain

- Volume slightly lower than on the day prior; however, this was a half day and it was on track to significantly exceed the 07/02 vol

- 07/05 TSLA had traded as high as $260 in the overnight session, sideways in the PM and opened with another small gap up

- Over four sessions: +~25% / ~$150B in market cap

- Clean, vertical price action with respect for R/G and no consolidations

- Historical extremes in terms of distance from KMAs

- Day 3 after the catalyst that ignited the move (high probability reversion day following two gap ups)

Before moving on to the intraday chart it’s important to point out the differences in TSLA’s weekly chart compared to the semis on their parabolic tops:

- TSLA: breakout from a multi-month base with muted PA, lowered volatility, and reduced volume. This was the first (admittedly very large) weekly green candle of the move

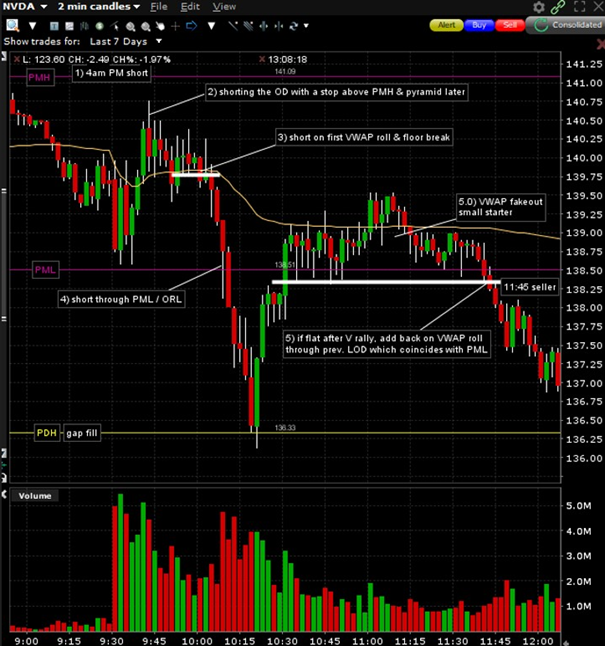

- NVDA: leading up to both 03/08 and 06/20; several large green candles on the weekly with price expansion and ($) volume acceleration trading way above the uBB before the reversal days

- SMCI: a weekly chart for the ages; picture perfect price & volume acceleration into the move, parabolic on all TFs

The weekly chart is a factor I didn’t acknowledge enough on TSLA. While it was extremely extended in the short-term, it lacked the overextension on the higher timeframes that was present on the semis. The more timeframes are in alignment, the more the rubber band gets stretched and the more explosive the move in the opposite direction when it finally unfolds.

Additionally, the semis were (are) the market; when that sector as a whole rolls over, the indexes follow. TSLA on the other hand was a lone wolf; it’s the clear (only) leader in the EV space and the sector just doesn’t pull the same punch. Even if this was the day where TSLA got dumped it wouldn’t single-handedly pull the indexes with it. Conversely, if the indexes rallied the way they did, that momentum would serve as a significant headwind to any attempts at a breakdown on TSLA.

Intraday Chart

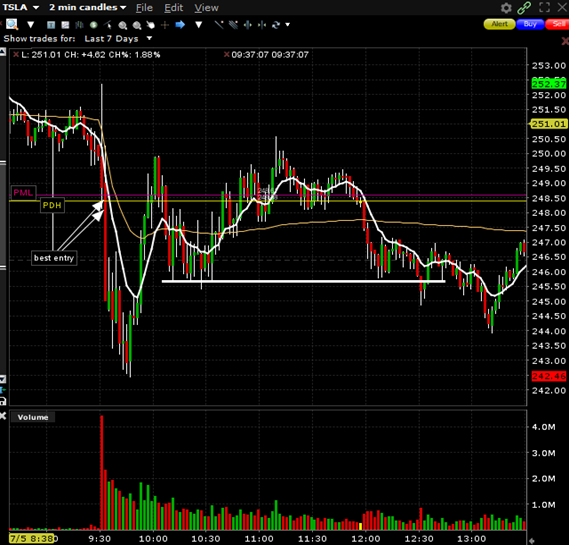

- Traded up to $260 in the overnight session

- PM trading opened at ~$250, traded up to $254 2m later, a price it wouldn’t revisit

- Tested PML at 7am but held, continued trading in a range between ~$249-$253

- Opened right at PML/PDH, attempted to push towards PMH and failed

- Rolled over, broke PML which aligned with both ORL and PDH

- Quickly flushed 3 pts lower, got sold into on the first bounce and broke lows again

- Huge buyer defended $243, briefly broke only to reclaim

- V-shaped recovery through VWAP but rejected at $250

- Consolidated below VWAP, broke consolidation range lows but reclaimed again and continued higher, breaking (and failing) $250

- Broke back below VWAP, consolidating at the same $245.5ish level, AGAIN breaking & reclaiming it

- One more attempt at FT lower but buyers stepped in again. Ended up grinding higher from here closing near highs

How I Traded it

I had planned for the following scenarios for a trade out of the open.

- Gap higher, parabolic move at the open through PMH towards $260 giving the opportunity to short a sharp turn (ideal case).

- Gap higher, test & rejection of PMH. Short through ORL.

- Gap down and trades higher. Look for failed break of PMH or PDH to short or a range break.

- Gap down and heavy straight out of the gates. Look for a 2m ORB to short.

What ended up happening was scenario #2: small gap higher, attempt at continuation higher at the open followed by a swift reversal and break of ORL. Brief attempt at holding PML/PDH failed. Those were the best spots for an entry with HOD stop best highlighted on a faster TF:

I’d like to blame my failure to capture this entry on trading on a crappy laptop on vacation but truth be told I was simply too slow on the order entry. Was hell-bent on taking options over equity and punched my hotkey with the order being rejected because of the offset being too wide. When I had that resolved the opportunity had already passed and the last thing I wanted to do was chase with options delta exploding (more on that later).

Proud I remained clear-headed, didn’t let

FOMO take the reins and seduce me into taking a terrible trade at lower levels.

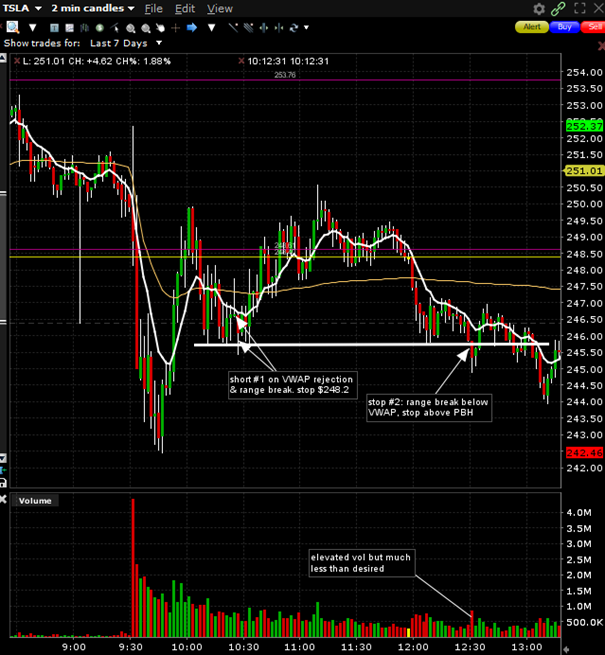

The V-shaped recovery that followed was eerily similar to the PA on NVDA on 6/20 which was a precedent I had heavily relied on in my preparation. TSLA consolidated in a fairly well-defined range ($245.7 – $248.15, ~10:10-10:40am window) and at this point I was open to both a break of that range to the downside where I wanted to get short and a break through highs confirming a reclaim of VWAP and good odds for continuation through $250 and an attempt at HOD where I wanted to go long. I reasoned with how crowded this short was, there was a lot of liquidity above HOD and thus potential for a squeeze should highs break.

TSLA ended up rejecting VWAP on a topping tail where I took a starter, adding on the break through the consolidation range lows with a stop at $248.2. It reclaimed immediately and stopped me out shortly after.

It proceeded to oscillate around VWAP without either side gaining control. I was eyeing the $250 break but the tape was weak and it swiftly stuffed. TSLA ultimately broke back below VWAP and consolidating mid range above a fairly well-defined flat base, exactly like NVDA did on 6/20 (see below).

Took a second stab at the short on the breakdown through the range lows with a stop above PBH. What I would’ve ideally liked to see was decisive follow-through on high volume; the stock initially traded a point lower on slightly elevated volume but didn’t follow through – red flag.

It once more reclaimed, stopping me out. I had split my DML between these two trades, was down 87% of what I wanted to risk and decided to call it.

In hindsight, the devil was once more in the details: as I alluded to earlier, the semis are the market; when that sector rolls, indexes follow. TSLA shorts on the other hand had to contend with indexes that were relentlessly grinding higher, a major headwind. Secondly, the time of day wasn’t ideal. NVDA broke its range at 11.30 am, at a time that could still be considered fairly close to the open. TSLA on the other hand broke at 12:30 / lunch time. We had seen successful FT at odd times this year on the best reversals; however, those had consolidated (bouncy ball) at LOD as opposed to mid-range which is always a much better setup. Options pricing was out of whack (more on that later); I was aware of this and had even mentioned the possibility of MM trying to pin the stock between the strikes with the highest OI ($250C & $240/$235P) during my PM prep. While the setup was fine this should’ve made me take equity over options.

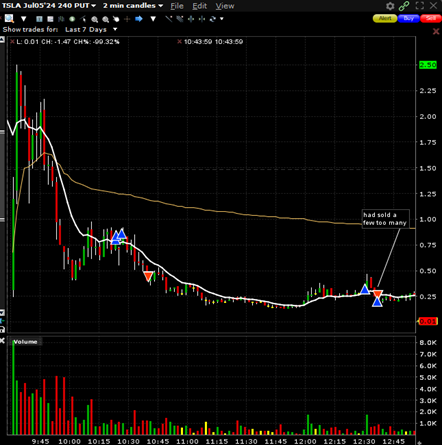

A few Words on the 0DTE Options

When I explained my reasoning for taking 1DTE puts on NVDA on 6/20 this is what I said: “For the simple reason that options on outsized reversals offer the best asymmetric payoff with clearly defined risk.”

While I now realize that equi-distant far OTM puts being a lot cheaper than calls only scratched the surface and the factors that made those puts a lot more appealing than the TSLA options were a LOT more nuanced, it played a big role.

I had realized on the day prior that puts were only slightly cheaper than calls on TSLA and that didn’t really change on Friday – what made puts so attractive on these parabolic reversals earlier this year was the asymmetry; markets only assigned a 5-10% probability of those puts going ITM on NVDA (I believe it was ~2% on certain strikes on SMCI in February). TSLA puts on the other hand were anything but cheap. When the stock opened at $250 and gained $2, $240ps more than doubled in price. IV shot up to 145 (from 60 the prior day) which implied a >8% move (in $terms ~$231). On the first $1.5 bounce off $243 they dropped by 50% and didn’t even manage to get close to HOD prices despite the stock trading 3 pts lower.

For comparison, IV on NVDA on 6/20 remained steady throughout the day:

The trade was very crowded; the TSLA 0DTE short opp was the talk of the town on fintwit the evening prior. Anyone who had missed the incredible opportunities on semis reversals earlier this year was eager to make up for it by hammering this TSLA trade. Traders were front running the reversal chasing puts higher at the open.

I’m a novice when it comes to the nuances of options trading but even I realized that this massively skewed the EV of the play and I should’ve come to the conclusion that if I got involved at a later point I should do so via equity instead of options. Instead, I insisted on trading the options which was a major mistake.

Max pain meant TSLA staying range-bound, bagging both puts AND calls.

How I Should Have Traded it

As I stated earlier, I believe the highest EV opportunity was the short through ORL/PML/PDH shortly after the open.

If I had gotten that entry, would I have banked on it? I’m not entirely sure.

Would I have covered when the $243 bid kept refreshing? I’m not sure, in fact in don’t think I would’ve. I would’ve probably ridden it back to b/e and covered above VWAP.

I believe the two trades I took were fine; those were by no means A+ intraday setups but in the context of the daily chart and with the NVDA precedent in mind they deserved some risk.

In summary, I doubt there was a way for me to get green on this today even if I captured the best trade of the day at the open.

Lessons Learned

- Importance of multi timeframe alignment, especially the weekly chart. A reversal on a name that’s extended on all TFs packs a lot more punch than the reversal on a stock that’s only extended on shorter TFs

- A top on the former causes traders active on all sorts of TFs to take action:

- Investors & position traders reducing long exposure

- Swing traders either taking profits or starting short positions

- Day traders getting short

- A top on the former causes traders active on all sorts of TFs to take action:

- PA on indexes being a deciding factor even on a mega in-play name

- Indexes making a strong directional move intraday presents a major headwind for a trade in the opposite direction, regardless of how good the setup on the specific stock may be

- Options nuances

- Still got a TON to learn in that regard but when something seems off (like put prices increasing with the stock trading 2 pts higher) caution flags need to go up and it’s hands off or trading equity over options

- Additionally, not having my hotkeys adjusted to trading options was a lapse in preparation that isn’t acceptable on what could’ve been a month-making day

- Crowded trades/sentiment: another factor that added to the quality of the SMCI/NVDA reversals was retail chasing price higher

- Longs – especially those who chased – were caught off guard and found themselves trapped in poor positions

- The TSLA short on the other hand was THE topic on fintwit and IV exploding at the open clearly showed how traders were racing to get positioned short

- This allowed MMs to effectively hedge their exposure, thus preventing the snowball dynamic of falling prices & MMs selling to get delta neutral that added so much fuel to the reversals on semis this year