Gen-AI fiber & cable contract with GLW

Market Context

Fairly irrelevant for this trade but could always serve as a minor head or tail wind. The Qs had pulled back ~8.5% over the last two weeks following the 7/11 CPI print and rotation from leaders into laggards. Over the last three trading sessions the index mustered a very weak bounce into the declining 10d EMA which it rejected today, confirming continuation lower by breaking last week’s lows.

LUMN Key Figures

- Market cap $2.5B

- 1.797B share float

- 66.93% institutional ownership

- 13.86% short interest

- ADV(5y) 10.9M shares

- ATR(10) $0.13

Worth noting this is a billion-dollar company, not a random micro float. Makes today’s PA a lot more significant.

LUMN Long-Term TA

Terrible-looking weekly chart: LUMN had already been on a downward trajectory, consolidated around the $10 level for the first half of 2022 before breaking lower and starting to sell off in earnest. Over the next year it would drop another 90%, bottoming in 10/23 at a price of $0.78. From there it regained some of its footing but couldn’t put any real distance between itself and the lows, making LHs during H1 2024 and briefly even breaking back below the $1 mark.

On longer TFs, this is clearly a broken stock; however, is it really a name where one would expect a ton of overhead supply from bag holders? It’s safe to say that anyone who hasn’t bought into this in recent months and is still holding is deeply underwater on the name. Would those proverbial “long-term investors” use this opportunity to bail for a slightly smaller loss or would they rather want to see it through and speculate on a bigger reversal? I’d argue most would choose the latter; therefore, it’s not unreasonable to assume this could have legs.

Daily Chart

LUMN had reached its YTD bottom in late June and started slowly creeping higher from there. It gained 50% off those lows over the course of three weeks, traded sideways for a day and began the next leg higher three days ago. From there it doubled on increasing volume that reached capitulatory levels today.

The Catalyst

On 7/25 MSFT & LUMN announced a strategic partnership to enhance AI capabilities and drive digital transformation. Lumen’s Private Connectivity Fabric is supposed to enhance MSFT’s network capacity and capability, addressing the increasing demand on data centers fueled by AI advancements. The partnership is expected to boost LUMN’s cash flow by more than $20M over the next year. LUMN closed that day near highs and followed through over the next two days.

On 7/30 (today) GLW a $33B company reported Q2 earnings and the CEO attributed the company’s performance primarily to “the strong adoption of new optical connectivity products for generative AI. In the third quarter we reached an agreement with Lumen Technologies that uses our new gen-AI fiber and cable system to facilitate Lumen’s build of a new network to interconnect AI-enabled data centers.” While there were no concrete $ figures mentioned, this deal could apparently have the potential to turn LUMN around.

Intraday Chart

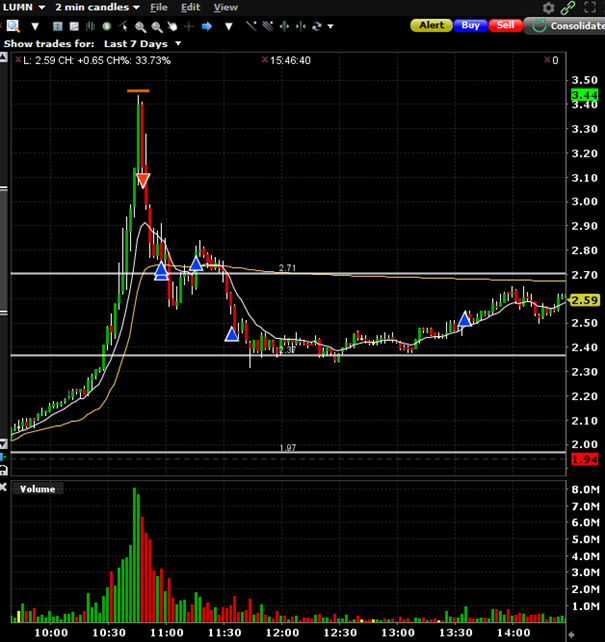

What’s weird is that the catalyst that supposedly ignited today’s move (the GLW CC) took place in the PM at 8:30 am, yet LUMN barely gapped up a few % points and even retested PDH at the open. From there it started slowly drifting higher, gaining ~10% before price started accelerating. LUMN broke a couple minor daily pivots (2024 & 2023 swing highs) and there were a few instances where it looked like the this was the turn, most notably on the two topping tails at 10:34 and 10:36 AM.

Instead, LUMN broke highs again and went parabolic with the HOD vol eclipsing the prior bar’s vol by almost 2x. As I mentioned earlier, this is a billion-dollar company with a 1.7B share float; this type of PA on such a name is truly astonishing. To put it into perspective, on the HOD bar it traveled almost 3x its ATR and did almost an entire average days’ worth of volume in a single 2m bar. Some of that can likely be attributed to shorts on multiple TFs getting squeezed (13.86% SI and intraday shorts capitulating).

When it finally broke 2m PBL, it basically flushed straight into VWAP. After faking out those using a 2m PBH TS, LUMN cracked VWAP but reclaimed it on the retest before rolling over again.

I think it’s worth mentioning that I believe this was a trade where one could’ve struggled executing cleanly on a TF faster than the 2m. One could’ve caught the turn there too but likely not without getting faked out (multiple times) on the front side. In fact, the turn on the 5m looked even cleaner than it did on the 2m.

Picture perfect price action and volume profile with HOD vol on the turn and an entry through 5m PBL which closed at the lows on a huge topping tail. As with all things in life, there’s always a tradeoff between earlier entries (better cost basis) and more confirmation (worse cb).

Options Chain

This was the options chain on the front side in the ~$2.65 area. Remember the stock gained almost another point from there. IV highly elevated at 244.6%, OI massively skewed towards the call side.

How I Traded it

I waited for a purely systematic entry on break of 2m PBL with a HOD stop. Lots of seasoned parabolic traders shorted intrabar for various reasons. Personally, I’m not at that level yet and thus prefer a purely systematic approach, again sacrificing a slightly better cost basis for the confirmation through PBL.

I do however understand that one could’ve gotten tempted trying to anticipate the reversal intrabar on several occasions based on the tape:

- 10:34 AM hidden seller at $2.7, when that cleared LUMN continued to $2.75 but reversed and the bid got slammed with the stock trading at $2.58 a mere second later.

- It recovered, made new highs and 2m later massive sell orders hit the bid again with the stock threatening to close at the lows of the bar on HOD vol.

- There was a massive iceberg at $3; when that got taken out, LUMN continued for another $0.1 where it ran into the next wall. It rejected hard and traded back below $3.

Once the top was in there was a hidden seller that kept reloading (starting at $3.25) and began walking down the offer from $3.08-$3.07-$3.02-$2.98-$2.94 and large visible orders started appearing on the offer as well.

The tape slowed down with LUMN approaching VWAP, it briefly bounced which would’ve faked out anyone using a stop above 2m PBH before cracking VWAP where I covered half. With a front side this linear, a stop above PBH was perfectly reasonable. I decided to use 5m PBH because the reversal on that TF was the cleanest and I wanted to give it a little more room in case it truly wanted to unwind.

Unfortunately, it didn’t cooperate too well, reclaimed VWAP and broke 5m PBH where I covered another quarter; decided I’d risk a break above the LH at $2.91 on the last quarter.

LUMN eventually rolled over and broke back below VWAP, accelerating lower. Went down to 15% on the break of the half dollar and trailed the rest as long as the trend (LHs & LLs) remained intact which stopped me out when it broke above the LH at $2.52 in the afternoon.

How I Should’ve Traded it

Honestly think I did pretty well. VWAP/a 50% retracement is usually my target for half of the position. Believe the 5m PBH trail was also superior to 2m PBH. I didn’t particularly like the VWAP reclaim which is another argument in favor of lightening up there. Held the last quarter pretty well and stopped when the trend shifted.

With it closing basically mid-range I don’t think one could’ve justified holding a piece overnight.

What I believe is worth mentioning is the idea of selling naked calls on the turn, also with a HOD stop. With IV sky high, the $3 weekly calls got absolutely smoked, tanking >50% intrabar. When LUMN cracked VWAP they were almost worthless. A few issues with this strategy: without an intrabar entry this might’ve constituted a chase. Had LUMN made new highs one would’ve likely eaten a good amount of slippage with how volatile these were.

Lessons Learned

Simple systems work: this wasn’t an easy short and I heard from a few very experienced traders who took a couple Ls on the front side on intrabar entries. Not once did it break 2m PBL on this whole move and from a purely systematic standpoint, there was no reason to take a trade until it did – which ended up being the turn.

There’s always a tradeoff between having a better cost basis by anticipating the turn intrabar or waiting for confirmation on break of PBL. It’s difficult to tell which has higher EV without the benefit on hindsight but generally, when a stock is getting this extended, there’s enough meat on the bone to wait until it confirms through PBL before taking an entry.

Fakeouts are common but once the top is in following a parabolic move, the first LH is rarely the spot where you want to stop out. A stop above PBH works really well, especially when the front side is this linear and one can expect a similarly clean move on the back side; however, you don’t want to get wicked out by small bounces either which speaks in favor of either using a PBH stop on a higher TF (e.g. the 5m) or adopting a more discretionary approach to TS management.