Delayed Robo Taxi Unveil

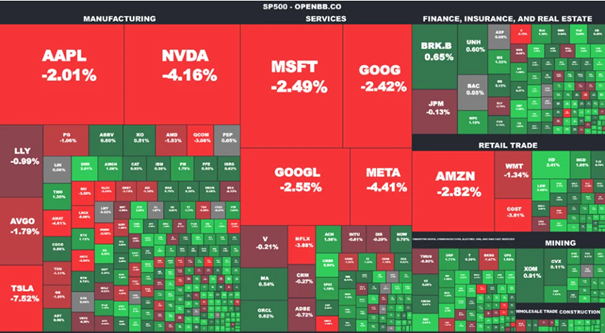

Market Context

Price action on the indexes played a significant role in this trade which I’ll elaborate on in more detail later. Relentless grind higher on the indexes in recent weeks, the Qs in particular with shallow dips getting bought aggressively and the Qs trading at / breaching the uBB on several occasions. While overextended by almost all technical measures, neither price nor volume action were capitulatory and could still be described as orderly.

During the last week, indexes had continued melting higher and every attempt at continuation lower eventually reversed with the Qs closing at/near highs. Wednesday was no exception with rumors about leaked CPI data. With how extended the broad market was, this print had the potential to significantly influence its direction.

CPI declined 0.1% from May, putting the 12-mo rate at 3.0%, it’s lowest level in more than three years.

It’s important to note that this had been a fairly narrow rally with most of the gains being attributed to mega cap tech companies and “risk on” assets best represented by the IWM underperforming significantly. Another positive CPI print – especially of this magnitude – could see money rotate from leaders to more interest rate sensitive assets (i.e. smaller names more dependent on cheap borrowing).

In response to this number, the probability for a September rate cut increased to >90%.

TSLA Daily Chart

- TSLA had been by far the weakest of the Mag 7 trading down 25% YTD when it broke above the DTL on 6/26 on the approval of Elon’s $56B pay package

- Break above 02/24 swing highs on HRV on 07/01

- The catalyst that ignited the parabolic move were better-than-expected Q2 delivery numbers in the PM on 07/02 (444k deliveries vs 437.8k(e)) after consistently missing on the prior three numbers

- With the legacy auto business appearing to slow down, the robo taxi prospect and its planned unveil on 8/8 had garnered a lot of attention

- Sentiment was extremely poor and expectations low

- TSLA gapped up on that number and closed the day at highs

- The catalyst that ignited the parabolic move were better-than-expected Q2 delivery numbers in the PM on 07/02 (444k deliveries vs 437.8k(e)) after consistently missing on the prior three numbers

- 07/03 gap up continuation with another ~5.5% intraday gain

- Volume slightly lower than on the day prior; however, this was a half day and it was on track to significantly exceed the 07/02 vol

- 07/05 TSLA had traded as high as $260 in the overnight session, sideways in the PM and opened with another small gap up

- Extremely crowded short setup and a day where both call & put buyers got bagged with TSLA trading in a narrow range closing near highs

- Grindy continuation higher during the next three trading sessions and the first hint of weakness on 7/10; basically, a digestion day with a close mid-range

- This action isn’t ideal for a mean reversion short with neither price nor vol capitulating (TSLA continued to trade on highly elevated vol); however, both a large move on indexes and unexpected news could always derail a strong trend

- While mega caps tend to trade like a hybrid between a stock and commodity (which can trend for 10-14 days), TSLA hadn’t broken PBL in 10 sessions which was exceptional even for this cult name

In my 7/5 review I had mentioned the lack of extension on the weekly chart compared to where semis like SMCI & NVDA were trading when they had their parabolic reversals as a big factor for why the odds for follow-through on TSLA that day were lower.

On the best parabolic reversals, you ideally want all timeframes in alignment, including the longer ones like the weekly chart. That hadn’t been the case on TSLA a week ago; however, it was getting there now with another sizeable green candle – again on highly elevated volume – following last week’s.

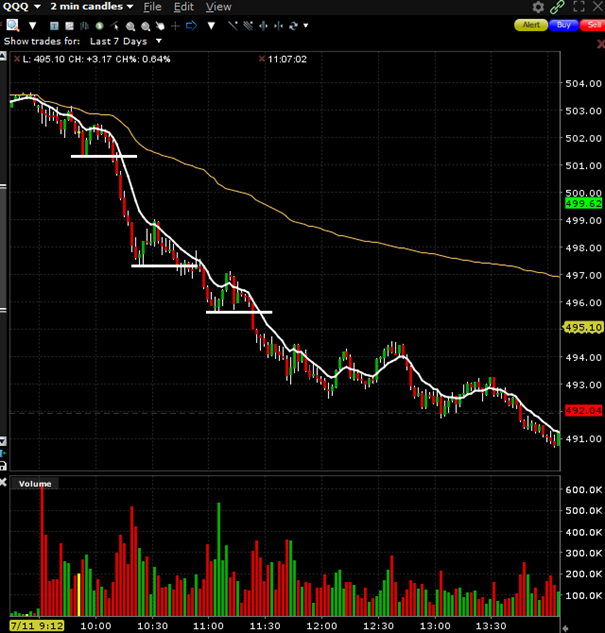

Circling back to my opening remarks on indexes; in last week’s write up I had stated that TSLA didn’t pull the same punch that semis as a sector do and was thus more dependent on alignment with indexes for a big move (especially against the prevailing trend) to take place. On 7/5 indexes rallied strongly which served as a major headwind for continuation lower on TSLA and likely played a big role in why sellers never gained control. Conversely, on 7/11 indexes – more specifically QQQ – rolled over hard following the light CPI print with money rotating from leaders into laggards (IWM).

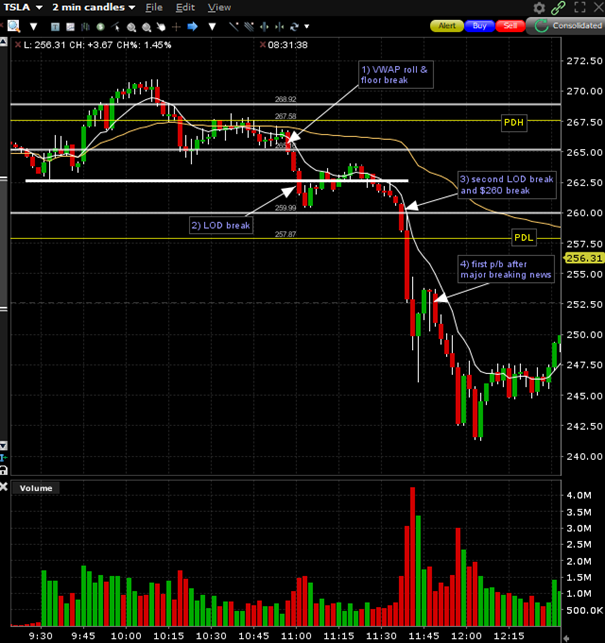

You can clearly see how there was good follow-through on LOD breaks, bounces were extremely weak and got rejected quickly, and volume was elevated on breakdowns – clear signs sellers were in control that day.

I don’t want to go on a tangent but here’s a couple of examples for PA on proxy stocks that day:

Again, consistent follow-through on LOD breaks, even on subpar setups that would most likely fail on an average day.

While TSLA had started this rally on a catalyst that fundamentally changed its outlook, those effects would eventually abate and make the stock much more susceptible to large moves on the indexes which is why I believe the extreme weakness on the Qs was such an important factor to highlight.

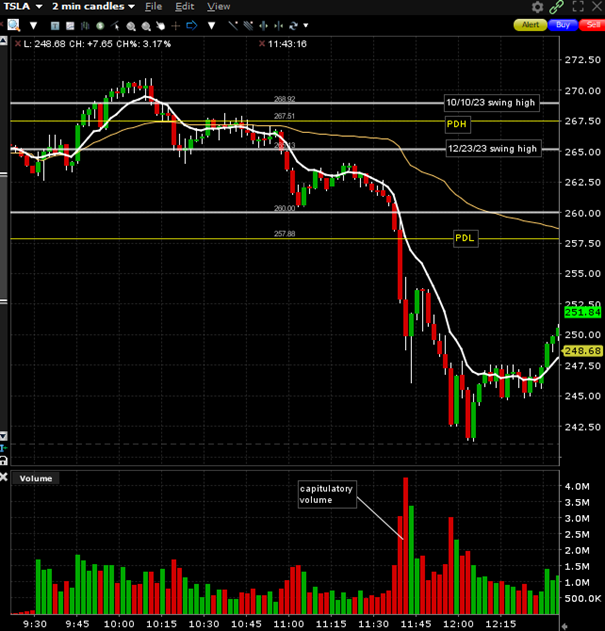

- Traded below PDH in the PM, initially fading alongside the Qs following the CPI print

- Caught a strong bid after the open, held LOD on the retest and rallied strongly through $270

- Stalled out 40m into the session, pulled in and broke back below the 10/10/23 swing high

- Brief attempt at holding VWAP & PDH followed by a break on volume

- Retested these levels, put in a LH and broke lower with both price and volume accelerating into the move and through ORL/LOD

- $260 had been a significant level during the last session (+ first major psych level support) that held on the first test

- Another pretty weak bounce followed that retested prior LOD and TSLA again rolled over from there

- TSLA broke $260 on elevated volume and 2m later – at 11:39 – news about the robo taxi delay broke

- Over the next 6m TSLA proceeded to drop $14 on capitulatory volume

- It retraced ~50% of that move on the first bounce, rolled over again and once more broke LOD on very high volume that didn’t quite measure up to the spikes on leg #1

- From there TSLA traded sideways in a rather narrow range making LHs (volatility contraction) against a fairly well-defined base at LOD

- Broke that base during the last 30m before the bell but reclaimed closing near lows

How I Traded it

Following the shift from a parabolic extension on the daily chart towards a more gradual grind my approach to a potential TSLA reversal trade had changed as well; I was no longer looking for a very specific setup at the open but rather planned on looking for a change in character in the price action before I would consider a trade. Specifically, I was looking for a break of ORL/LOD following a strong open which we hadn’t seen during this entire run – TSLA had either sold a little after the open and recovered to close strong or shown strength right out of the gates grinding higher all day.

I was traveling, only had my laptop with me and had to rely on a bad internet connection on the train. The only option I really had was to participate in a bigger picture trade if it were to present itself.

I went short when TSLA cracked LOD on volume with a wide stop at HOD. $260 had been a well-respected level over the last couple of days and I had planned on covering a third on its break into PDL thinking it could find support there. In hindsight, I’m not sure this cover was correct: as I mentioned earlier, TSLA hadn’t broken PDL at any point during this rally so when it did that was one of the clearest changes in character possible and a good signal for a potentially bigger move. Instead of playing it safe and locking up some profits there I could’ve held the entire position speculating on a bigger unwind.

News about the delayed robo taxi reveal broke two minutes later and TSLA accelerated lower on major volume. I didn’t realize it had breaking news until it traded $252 where I had already covered another piece. Took a little more off into/through $250 and held the last quarter through the first pullback. I had thought about holding this quarter until EoD for an all-day fade and even contemplated swinging 10% overnight if we closed weak for a D2 but then realized TSLA had retraced almost 40% of the entire 10-day move from $200 within the span of two hours and I wasn’t sure there was positive EV in speculating on an even bigger move.

How I Should Have Traded it

It wasn’t easy finding a historical precedent for a comparable move on TSLA; 06/21/23 was probably the best comparison:

Broke from a multi-month consolidation range and rallied for ~two weeks straight. It did however have a couple of inside bars/digestion days and even broke PBL on a few occasions which spoke in favor of today’s daily setup.

When TSLA reversed on 06/21/23, it closed at LOD on an engulfing red bar having traveled a little >1ATR and it continued lower on the following day.

Therefore, the minimum range one could’ve expected if 07/11 was the top of TSLA’s current run, was a ~1ATR / $13 move from HOD. This roughly aligned with PDL in the $258 area and made that a much more valid PT. Given the higher quality daily chart (without a single break of PBL) on this run, one could argue that the odds for a reversal exceeding the range of the 6/21 precedent were good.

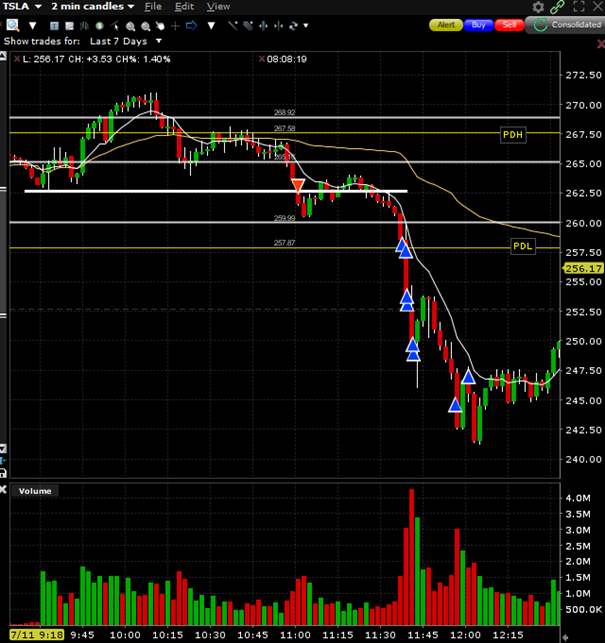

TSLA had shown extreme RS during the first 40m while the Qs had already shown they were vulnerable. When the Qs broke lows at 10:08 TSLA was still holding above VWAP and only broke that when the indexes were cascading lower (still a sign of relative strength). I don’t think there was any reason to be short TSLA at that point; if indexes found any kind of support odds for TSLA trading sideways or bouncing were pretty good.

It continued to consolidate below VWAP for the next 45m. During that timeframe the Qs were also trading sideways after a weak attempt at a bounce was swiftly rejected. When QQQ broke lower on volume at 11am it seemed a second major down leg was imminent. That’s when TSLA reversed too and broke the small floor it had built below VWAP on volume (very reminiscent of how the reversal on NVDA on 6/20 started); imo this was the first legitimate spot where one could’ve taken a short with a stop either above the highs of that hour-long consolidation range or a close back above VWAP.

The second opportunity was the LOD break which was confirmed by elevated volume. One could’ve structured this trade aggressively with a stop above the b/d bar’s highs or given it more room back above VWAP or even HOD. TSLA held $260 on the first test which had been a significant level from the prior few days. It followed that up with a weak bounce that didn’t even retrace half of that last leg.

When the Qs broke their consolidation range to the downside, TSLA too broke $260 and accelerated lower. This was the third possible entry either with an aggressive stop above the 2m b/d bar’s highs or above the consolidation range. Shortly after the robo taxi news broke and TSLA fell apart. Calls bought in anticipation of that unveil should now be sold or rolled to a later expiration exacerbating the move. Everything lined up for a short here: extension on multiple TFs, rally at the open bagging call buyers, negative catalyst, Thursday (options unwind), tailwind from indexes. The first leg is what you want to catch with size, everything after – except for the bigger picture trade – is negligible. If I wasn’t short yet and I wanted to get short on breaking news I’d try to do so ASAP and risk the unaffected price.

This was the first break of PDL of the whole run from $200 and would’ve been on the radar of most traders regardless of their primary TF; when levels where everyone is alignment (longs want to reduce exposure/lock in profits, shorts want to start positions or add to them) are breached, they carry the potential for outsized moves. I would argue TSLA would’ve continued lower on this break even without news although the move would’ve likely been smaller/shorter-lived. Over the next 5m TSLA continued $15 lower which was a full ATR on capitulatory volume. It was only prudent to take some profits into the move and either stop on the whole position or reduce more size on the break of PBH in the $252 area.

The bounce that followed was fairly weak, confirming that the news was substantial and continuation lower could be expected. Therefore, shorting the turn on this bounce looking for a move to/through LOD was another viable setup.

Usually, the 3rd leg lower doesn’t see good FT but the news catalyst changed that (this would only be leg 2 following breaking news). This isn’t a trade I’m familiar with so I would’ve stayed put.

PA at lows was very indecisive and TSLA never set up for a clean “right side of the V” long (choppy, couldn’t get a good read on the tape, LOD break followed by quick swipe higher and give back).

TSLA proceeded to consolidate for the next 3.5 hrs with volatility contracting (LHs) against a very well-defined flat base at LOD (in bouncy ball fashion). I believe shorting the break of those lows with a stop above the b/d bar’s highs was another feasible setup.

Lastly, with TSLA closing at lows after a 30 pt move (almost 3ATR) on the highest volume of this entire formation, the odds it would see follow-through to the downside on the next day were pretty good (with the last precedent being NVDA on 6/20). Therefore, either holding part of an existing position or establishing a new short position into the close was worth considering as well.

TSLA ended up gapping almost 6 pts lower the next day before catching a bid shortly after the open and bouncing strongly.

Options or Equity?

Unfortunately, I don’t have a chart for options that day but from what I gathered from others on X who traded it using options, the opportunity on 1DTEs was decent albeit not quite as good as NVDA on 6/20. Besides the pricing, one big negative was the lack of MOpex (higher OI = more potential for an options-driven unwind). The rally after the open was an argument in favor of taking options since the $270 call buyers got bagged and would be forced to unwind their positions adding fuel to the countertrend move.

If I wanted to take options, I would’ve chosen a fairly close strike ($260, $255 max) which would allow me to scale out with the options accelerating ITM on the back of the shift in delta. One could’ve then chosen to either hold for a bigger move or roll down to a lower strike which would’ve had the benefit of maintaining decent exposure while locking in risk.

The close was another point in time where one could’ve considered rolling whatever one had left to a lower strike for an overnight trade.

Options weren’t even a consideration for me on the train but if I was trading from home, I think I might’ve gone with a mix of equity (bigger picture trade with a wider stop) and options at critical junctures with tighter stops.

Lessons Learned

- I was too early on the 7/5 reversal attempt. Large caps can trend similar to commodities and defy what seems logical. Once they do reverse, they tend to follow through to the downside just as strongly though as seen on SMCI & NVDA earlier this year and in June. Therefore, piking the hold time isn’t an option. This isn’t just a momentum trade but also a bigger picture trade.

- Additionally, once a blowoff top is in, one should keep the stock on watch for a follow-up short on a LH against the highs of the reversal day. NVDA on 7/11 was a good example for that and a name one should’ve watched for continuation on weakness

- Likelihood of FT following an outside reversal with a close at/near LOD: we could observe the same thing on SMCI & NVDA earlier this year and again in June – gap down the following day, weakness at the open before catching a bid.

- Thus, there are two more setups worth considering: 1) the overnight short for the gap down and 2) the potential for a reversal long the next morning following early (ideally panicky) weakness.

- Lastly, stocks can reverse in many different ways. In an ideal world they would capitulate on all TFs including intraday on the reversal day and set up for a very clean short on the turn; that’s rarely the case. What you should be looking for is some sort of change in character before considering a trade / establishing a short position. One pattern we’ve seen repeat this year is the consolidation below VWAP and the stock rolling over, breaking through the last HL for an early short entry.