What is a Short Squeeze?

A short squeeze occurs when a stock unexpectedly rises quickly, forcing short sellers to buy their shares back. This sudden buying activity drives the price even higher, creating a feedback loop that can push shares to extreme levels.

Short squeezes are often triggered by unexpected news or hot market cycles. They can result in significant losses for short sellers and rapid gains for momentum traders. Commonly seen in volatile markets, short squeezes are a key concept in stock trading strategies and risk management.

You can’t predict a short squeeze, BUT there are a few things that can help you understand the potential of a stock to have a short squeeze.

Why do Short Squeezes Happen?

The most common reason stocks have a short squeeze is when there is a high Short Interest and breaking news comes out. Short Interest is the amount of the float that is held by short sellers in percentage terms.

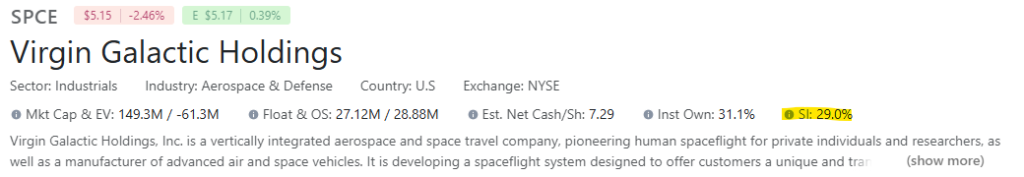

So if you look at $SPCE below, you can see I highlighted the Short Interest. It is 29%, which means that 29% of the float is shorted. That is a lot. Now what would happen if $SPCE came out with some really positive news that sent the stock catapulting higher?

Well, shorts would be forced to cover their positions to avoid further losses or they would be forced out by their brokers for Margin Calls. Given how many shorts there are, it will dramatically increase the buying pressure on the stock causing shares to reach absurd levels.

$SPCE is an extreme example of a high Short Interest. Not all stocks will have that much, but it’s always good to know what a stocks Short Interest is when trading it.

Other common ways that short squeeze’s happen is if there is a hot sector run. Recently, we’ve seen big runs in the Drone, Nuclear and Quantum sectors with lots of hype around new technology and regulations around those industries.

Short Squeeze Example

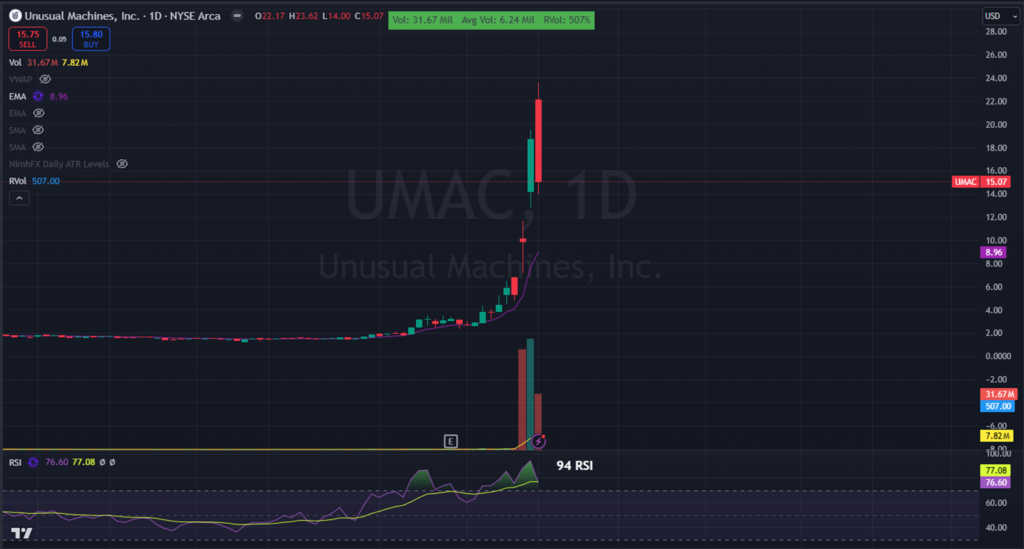

A good example of a recent short squeeze would be $UMAC when it made a massive run on news that Donald Trump Jr. would be joining the board. You can see below that it made a massive three day run before capitulating.

This is a great example of unexpected news hitting a fairly illiquid stock that sent shares ripping higher, catching shorts off guard and scrambling for the exits.

Another very famous short squeeze was $GME back in 2021 when it ran for over 2000% in just a matter of days. This was fueled by what’s called a Gamma Squeeze. This is a type of short squeeze that happens when a stocks Calls options are heavily bought. When this happens, Markets Makers who are selling the Calls, buy shares in the underlying stock, in this case $GME, to hedge their short Call positions. When the stock takes off and more Calls are being bought the MMs have to buy more shares, creating a loop of relentless buying in the stock.

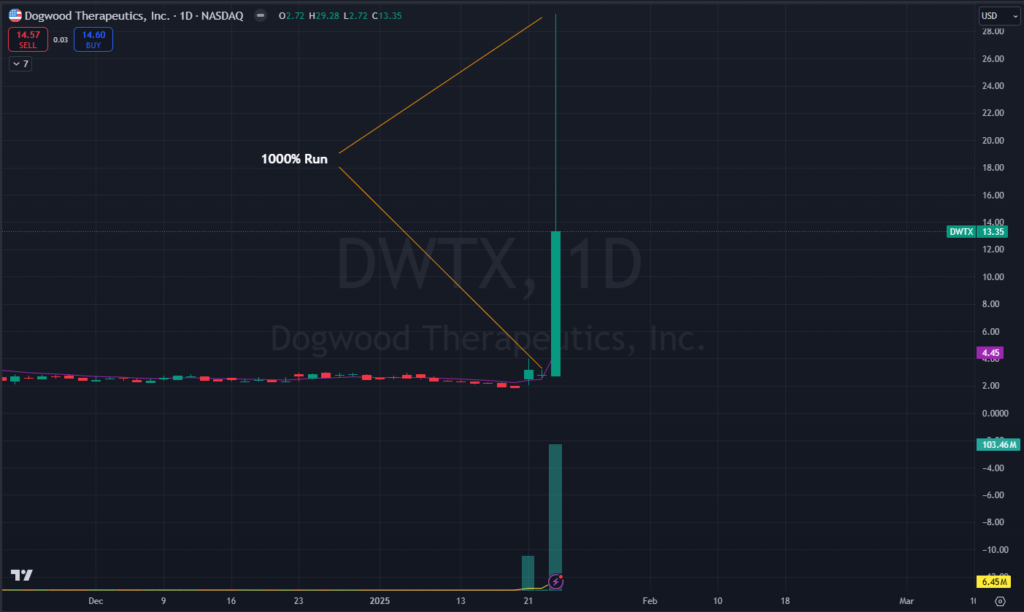

Another more recent example is $DWTX. This had no news but a very small float of just over 1 million shares. For whatever reason, it took off and never looked back, running almost 980% in a single day!

These moves can happen at anytime and for no reason. A tell tale sign of a short squeeze is relentless buying for an extended period of time. Every dip is bought up and each leg higher has elevated volume.

Trading Short Squeeze’s

Short Squeeze’s can provide excellent opportunities for both the long and short side with both offering excellent Expected Value. The long side can be a bit hard to predict because it’s hard to know how high a stock will go before it reverse’s which is why I prefer waiting for the backside, or shorting the parabolic move when it rolls over.

If you’re more of a momentum trader and like taking these plays long, then you need to be patient and wait for pullbacks (Bull Flags) to get involved. It’s too easy to get caught up in the moment when a stock is making a huge run and let FOMO cause you to make poor decisions like buying at highs just to see it reverse hard on you.

In the $USEG example above you can see there were multiple Bull Flag examples to get long on. You can also see the volume coming in on those breakouts, confirming the price action. This is what you want to see as a momentum trader.

On the flip side, if you missed the long opportunities, you should be careful about chasing prices higher. A better idea is to wait for the turn and short the backside of the move. If we look at the same $USEG chart below, there were a couple opportunities that would have set up for a short trade.

The idea here is you want to wait for prices to get extended or a good distance from the 10d EMA and VWAP. Then wait for price to break the prior bar low to short vs high of day. This gives you some structure to the trade with an entry and exit. Shorting parabolics can be risky business so a hard stop is a MUST. It’s easy to let losers get out of hand as price can move very quickly against.

Proper risk management is critical for all trading but especially when trading parabolic stocks. Losses can compound very quickly, leaving you holding a much bigger loss than expected. Always place hard stops and if you are new to trading don’t hold anything overnight, esp short positions. These types of plays can gap a lot in either direction.

Finding Short Squeezes

The best way to find short squeezes is with real time scanners. You want to be looking for stocks making big moves on high relative volume (RVOL), meaning much more volume than it normally does. Scanners help find these plays while they are happening so you don’t miss out.

Below are the custom scanner we use that help filter out stocks making big moves with high RVOL. They kick out the names as they meet our parameters so we know when we pull them up that they have potential to be a short squeeze candidate. You can trade without scanners but you will be missing a lot of opportunities!

Wrap Up

Short squeeze’s happen fairly regularly to varying degrees. The important thing to know about short squeeze’s is that they provide a ton of opportunity to both the long and short side. Have a solid gameplan or a playbook made just for parabolics is a great way to be ready when one shows up.

Like this article? Sign up below for more articles like this sent right your inbox!